Housing prices in Israel have risen by a national average of 47% over the past decade, with apartments in some cities appreciating by 78% over 9 years. How can potential investors take advantage of this trend?

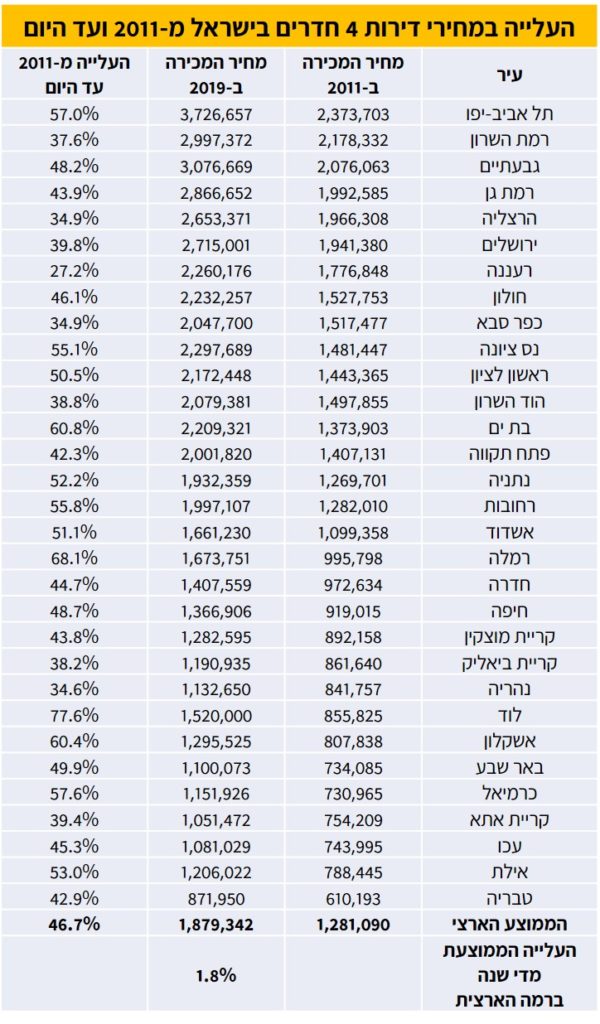

According to a study by the property resale website Yad 2 (shown below), the prices of 4-room apartments throughout Israel have increased in almost every city since 2011. 2011 was the year of the street protests over the price of housing and cottage cheese. In response, the government of the day promised to implement measures to increase building projects and create more affordable accommodation.

In an attempt to help first time buyers, it was suggested that some homes would be marketed with 0% VAT. The only effect of this suggestion was to temporarily suppress the demand for housing during 2014-2015, while potential purchasers decided to wait for this discount to come into effect. When it failed to materialize, the build-up of demand was released and caused a spike in house prices in 2016.

The next policy suggestion was an increase in the purchase tax for purchasers of multiple properties, and while this was being discussed it caused a flurry of property purchase among investors rushing to beat the tax. Political horse-trading prevented the government from introducing this investment tax.

Planning and building new housing projects inevitably takes time, and Israel has a constantly increasing population, so demand continues to outstrip supply. With low wage inflation over the past several years, people who cannot afford to buy in the popular central cities of Israel have been buying lower-cost properties in cities like Ramle, Lod and Bat Yam. As a result, the house prices in these areas have increased more dramatically over the past 10 years than in more expensive cities like Tel Aviv, Netanya and Herzliya.

Property management and investment expert Shaun Isaacson explains: “Investment in transport infrastructure, connecting the central conurbations with the periphery of the country, is helping to expand the commuter belt and making more distant suburbs more popular. That is why we see the housing market gradually flattening out in the coming years, with a smaller differential between previously cheaper and more expensive cities.”

In Lod, a 4-room apartment that sold in 2011 for 856,000 would now cost 1,520,000 NIS – a staggering 78% increase. In neighbouring Ramle, prices have risen by 68% from 996,000 to 1,674,000 in 2019. At the same time, comparable apartment prices in Ra’anana have risen by only 27% over the same period, from a starting price of 1,777,000 to 2,260,000 NIS.

“While Anglo investors typically choose the cities that they know personally, it is often more lucrative to invest in lesser known and cheaper locations, where prices are rising faster. This price list is a snapshot of one aspect of the Israeli real estate market, but we have a much deeper understanding of which areas are most profitable for buy-to-rent investors, and we are happy to advise.”

You can contact Shaun Isaacson at Creative Estates Israel in complete confidence, to discuss profitable investments and property management in Israel.