Taking the long view of Israel’s historical property “roller coaster” shows that predictions of a bubble about to burst are clearly wishful thinking for purchasers! Shaun Isaacson sees a long-term upwards trend that is likely to continue.

If I had a time machine, the first thing I would do is go back to 1948 and buy property in Israel.

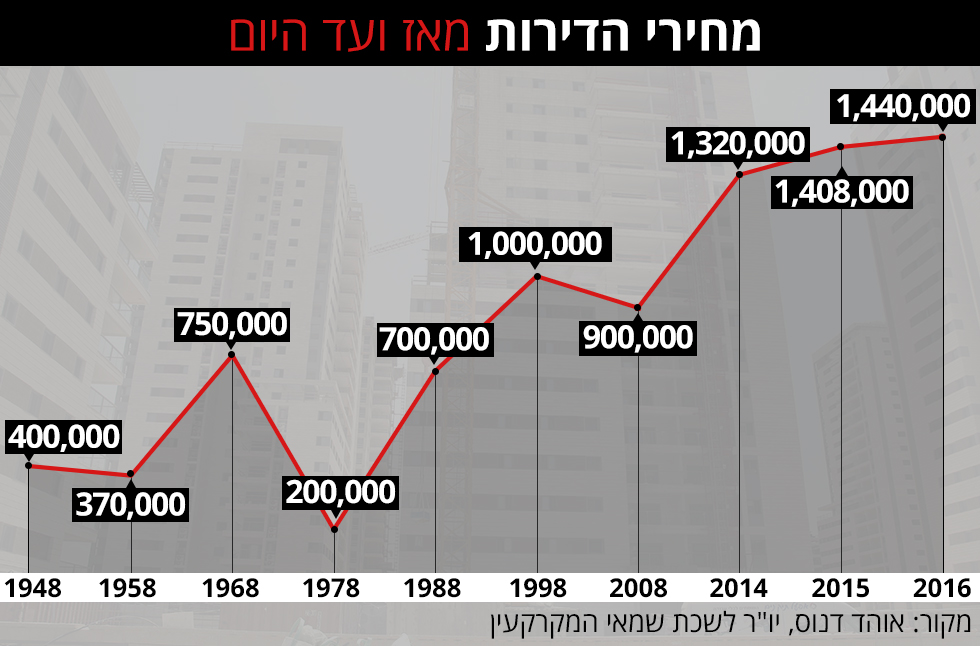

According to a historical survey by the Israeli Government’s Property Assessor, Ohad Danus, the prices of properties in Israel over the past 60 years have risen steadily. Over the past 12 months since June 2015, apartment prices rose by an average of 8%, but this is not some unsustainable “bubble” as some analysts have claimed. It is part of a steady trend. Examination of the exceptions to that trend – historic periods when prices dropped dramatically – shows that this trend is likely to continue.

In the late 1960s and 1970s the fall in real estate prices in Israel can be clearly attributed to Israel’s insecure security situation – wars and a crisis of confidence. However, the influx of millions of immigrants from the Former Soviet Union in the 1980s required huge construction projects to increase the supply of housing and resulted in an increase in prices, so that by 1989 property prices had returned to their 1968 levels and continued to climb until 1997.

In the late 1960s and 1970s the fall in real estate prices in Israel can be clearly attributed to Israel’s insecure security situation – wars and a crisis of confidence. However, the influx of millions of immigrants from the Former Soviet Union in the 1980s required huge construction projects to increase the supply of housing and resulted in an increase in prices, so that by 1989 property prices had returned to their 1968 levels and continued to climb until 1997.

Economist Yaniv Hevron from Excellence explains the second drop in prices – a decrease of almost 10% from 1997 to 2003 – as having been caused by the bursting of the hi-tech bubble, which had become the driving force in the Israel economy. He points out that the resultant global recession was followed by the Second Intifada from 2000-2003, which contributed to the lack of confidence among local and international investors. The contraction of Israel’s economy continued until 2008, with the international property crisis in 2007 having only an indirect and muted impact on Israeli property prices. Because Israel’s banks are reluctant to extend credit to home buyers, the property market was protected from the runaway credit crisis that hit the United States and many European countries. By 2008, prices had started to rise again, and that trend can be seen to be continuing through 2016.

Will the Bubble Burst?

Based on this long-term historic analysis, we can see that a fall in Israel’s housing prices is only likely to be triggered by a severe economic crisis or a significant war (G-d forbid!). Creative Estates CEO Shaun Isaacson, who follows these trends carefully, believes that there are more potential factors that are likely to cause continued price inflation in the years ahead.

“Increased Aliyah – whether from Europe or the United States, where the political climate is unstable – would undoubtedly put a major upwards pressure on property prices”, explains Shaun. “I am sceptical that the government can relieve the housing shortage by increasing the supply of new homes – over the past 2 years we have seen very little progress with this policy, and the rate of births and marriages in Israel’s fast-growing population will ensure that demand keeps pace with supply.”

What is clearly an issue for aspiring Israeli property owners is that the cost of buying an apartment or house remains out of reach for many. The historic price analysis carried out by Ohad Danus shows how property prices have risen when measured against the average Israeli salary. At the end of the 1980s, a purchaser needed to invest 80 times the average Israeli salary to buy an apartment. Today, one needs to allocate almost 150 times the average Israeli salary and invest 12 years of work in order to afford to buy an average apartment.

Shaun Isaacson explains that this statistic, more than any other, explains the strength of Israel’s rental market throughout the country. “While young people cannot afford to buy a home, they must continue to rent for many years, and that is why the rental market in Israel is strong and profitable for investors, and looks likely to remain that way for a long time!”

Shaun Isaacson and Creative Estates Israel can help with your property investment and management of your rental property in Israel – contact Shaun@CEIsrael.com for a confidential consultation.